Where we laugh. Pray. Cry. Fight. Forgive.

Grow old. Wrestle. Learn. Hold hands. High-five.

Hug. Love. And never want to leave.

New Home Purchases Refinances Cash-Out Refinances

The NEW Reverse Mortgage Program • VA, FHA & Adjustable Rate Loans

4-truths to hopefully make you say, “How could we use anyone else?”

1

We started as a small, family-shop long ago and still operate with the same foundations today. Dad John and his son, Ryan run the show. Mom Denise and her sister, Barbara answer most of the phone calls.

We’ve certainly grown a good bit bigger over the years, but the heart of “one-on-one special attention” has never changed. It is the foundation.

2

Despite our small-team mindset, we’re blessed to have a very special Direct Lender Advantage. Our Team is an arm of a much bigger company that is a Direct Lender. Because of that, our company gets to use its own money and make its own decisions within its own walls. There’s no middle-man. For you, this often means shorter turnarounds and a better rate, which can mean paying significantly less each month — whether you’re refinancing or buying a new home.

3

*Washington we pay $1,000 of your closing costs on new home purchases and up to $1,000 of your appraisal fees on any refinance..

4

One of the biggest things we hear is — “I’m curious to know what my options are, but I’m kinda too scared to ask.”

This one is a big deal for us. Because whether you’re thinking about buying a new home, cashing out some of the equity in your current home or doing a traditional refinance, there are always sooooo many options.

The only way to make the right decision for you and your particular circumstance is to ask questions and find out your options.

We take this extremely seriously. It’s our job to share your options. And then let you decide what’s best for you.

We wouldn’t be where we are without amazing partnerships with faith-based radio stations across the country. Tell us which one you heard our story on.

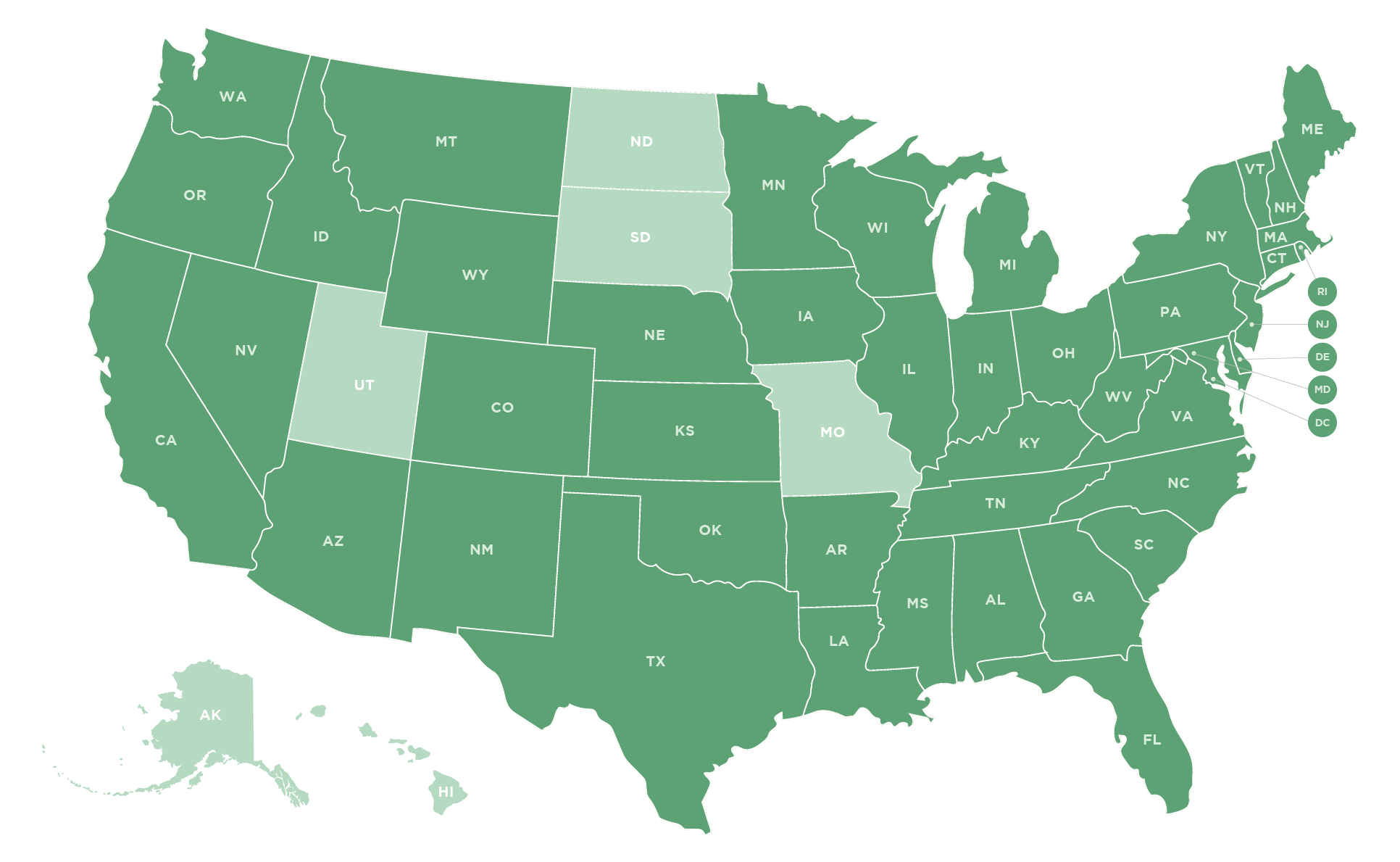

Unfortunately, not currently licensed in: Alaska, Hawaii, Missouri, North Dakota, South Dakota and Utah.

For many of us, right now is a unique moment of opportunity, to look into a cash-out refinance.

Arguably never has there been a crazy run like the last few years, where home values have skyrocketed at historical levels, leaving newfound equity or “extra money” sitting inside our homes. A cash-out refinance lets you put that “extra money” in your pocket — to use for ANYTHING YOU’D LIKE.

I have to say from the moment I called to ask questions about a possible refinance on our mortgage to the time we closed, the experience was excellent. Ryan was very knowledgeable and didn’t make me feel dumb when I asked questions. United Faith Mortgage helped us save over $1000.00 a month with our refinance. Ryan walked us through the whole process and made it such a pleasant experience. United Faith Mortgage is the way to go

United Faith Mortgage and Ryan were a pleasure to work with during the purchase of our property. From past experiences this process is usually difficult, time consuming and frustrating, trying to gather so much information just to get the process going. Not the case at all with United Faith Mortgage! So easy and convenient through phone calls and emails. Ryan was so kind, helpful and available even during the evening hours. We’ve had several homes and this has to be, by far, the smoothest, stress-free process we’ve been through. We have already highly recommended United Faith Mortgage to Friends and family that need to re-finance or are purchasing a home/property. Thank You United Faith Mortgage & Ryan for helping us ENJOY the purchase of our property!

Ryan and the team at United Faith were amazing! We were trying to pull cash out of our current home’s equity to help us purchase some land. Started with another company that said they could have an approval in a week. Two weeks went by with nothing from them and our seller was getting nervous. Reached out to Ryan and within a week we had our approval for the seller, and less than two weeks after that we were closing. Once we switched to United Faith it the whole process went so much smoother and faster, I wish we had just started with them.

Branch Office: 399 Conklin Street, Suite 206, Farmingdale, New York 11735 NMLS# 1504538

Equal Housing Opportunity.

This offer is made by United Mortgage Corp. d/b/a United Faith Mortgage. Corporate Office 401 Broadhollow Road, Suite 150 – NMLS# 1330 Melville, NY 11747, which is not affiliated with your current lender nor is it an agency of the federal government. United Mortgage Corp. d/b/a United Faith Mortgage is approved by HUD/FHA, Fannie Mae, Freddie Mac and Ginnie Mae. This is not a government form. This is not a credit decision or a commitment to lend. Rates, terms and programs subject to change without notice and may not be available at commitment or closing. Subject to credit approval. Refinancing an existing loan may increase total finance charges over the life of the loan. Equal Housing Opportunity. CCPA | CCPA Opt-Out | Consumer Access: http://www.nmlsconsumeraccess.org

Licensed by the AL State Banking Dept. Consumer Credit License #22737; Arizona Department of Financial Institutions, Mortgage Banker License #0951233, AR Securities Dept., Combination Mortgage Banker-Broker-Servicer License #118243; Colorado Division of Real Estate, Mortgage Company Registration; CT Dept. of Banking, Mortgage Lender License #8034; CA Dept. of Financial Protection & Innovation, under the Residential Mortgage Lending Act License 4130571; DC Dept of Insurance, Securities and Banking, Mortgage Dual Authority License,–MLB1330; DE Office of the State Bank Commissioner, Lender License # 9799; FL Office of Financial Regulation, License #MLD711 ; GA Residential Mortgage Licensee Lender License/Registration #1330; ID Dept. of Finance, Mortgage Broker/Lender License MBL-2080001330; IL Dept of Financial & Professional Regulation, Illinois Residential Mortgage Licensee MB.6760930. STATE OF ILLINOIS COMMUNITY REINVESTMENT NOTICE: The Department of Financial and Professional Regulation (Department) evaluates our performance in meeting the financial services needs of this community, including the needs of low-income to moderate-income households. The Department takes this evaluation into account when deciding on certain applications submitted by us for approval by the Department. Your involvement is encouraged. You may obtain a copy of our evaluation. You may also submit signed, written comments about our performance in meeting community financial services needs to the Department.; IN Dept. of Financial Institutions, License # 11046 ; IA Division of Banking, Mortgage Banker OTN#2 License #2020-0053; KS Office of the State Bank Commissioner Mortgage Company License, #MC.0001328; KY Dept. of Financial Institutions Mortgage Company License # MC379370; LA Office of Financial Institutions, Residential Mortgage Lending License; Massachusetts Division of Banks, Mortgage Lender/Mortgage Broker Licenses MC#1330; MN Dept. of Commerce Residential Mortgage Originator License OTN#1 MN-MO-1330.1/Servicer OTN#1 MN-MS-1330.1; MD Office of the Commissioner of Financial Regulation, License #19616; ME Bureau of Consumer Credit, Supervised Lender License # SLM9952; MI Dept. of Insurance and Financial Services License #FR0019241; Licensed by the MS Dept. of Banking and Consumer Finance, Mortgage Lender License 1330; MT Division of Banking and Financial Institutions, Mortgage Lender/Broker/Servicer Licenses 1330; NC Commissioner of Banks, Mortgage Lender License # L-124405; NE Dept. of Banking and Finance, Banker License; NH Banking Dept., License # 11422-MB; Licensed by the NJ Department of Banking and Insurance License #9909065/RMLA-Licensed Mortgage Servicer Registration; NV Division of Mortgage Lending, Mortgage Company License #5043; NM Financial Institutions Division, Mortgage Company License; OH Division of Financial Institutions, Ohio Residential Mortgage Lending Act Certificate of Registration License MBMB.850260.000; OR Division of Financial Regulation, Mortgage Lending License; PA Dept of Banking and Securities License # 22672; Rhode Island Dept. of Business Regulation, Licensed Lender #20163301LL, Broker #20163302LB, Servicer #20163303LS; SC Board of Financial Institutions, License MLS – 1330 OTN #1; TN Dept. of Financial Institutions, License # 109167; OK Dept. of Consumer Credit Licensing, Licensed Lender OTN#1 ML012055; TX Dept. of Savings and Mortgage Lending (see below); WA Consumer Loan Company License #CL-1330; WV Division of Financial Institutions Mortgage Lender License #ML-37986 / Mortgage Broker License #MB-37985; VA Bureau of Financial Institutions Lender License #MC-590; WI Dept. of Financial Institutions Mortgage Banker License #1330BA/Broker License #1330BR; WY Division of Banking, Mortgage Lender/Broker License #3571/Supervised Lender License # SL-4063. For licensing information go to: http://nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/1330

TEXAS: Consumers wishing to file a complaint against a mortgage banker or a licensed mortgage banker residential mortgage loan originator should complete and send a complaint form to the Texas Department of Savings and Lending, 2601 North Lamar, Suite 201, Austin, Texas 78705. Complaint forms and instructions may be obtained from the department’s website at www.sml.texas.gov. A toll-free consumer hotline is available at 1-877-276-5550. The department maintains a recovery fund to make payments of certain actual out of pocket damages sustained by borrowers caused by acts of licensed mortgage banker residential mortgage loan originators. A written application for reimbursement from the recovery fund must be filed with and investigated by the department prior to the payment of a claim. For more information about the recovery fund, please consult the department’s web site at www.sml.texas.gov.

See our Privacy Policy: https://www.unitedfaithmortgage.com/policies/

This website is not authorized by the New York State Department of Financial Services. Until this website is authorized, no mortgage loan applications for properties located in New York will be accepted through this site.